Income tax slabs FY 2025-26 under Old & New Regime

Navigating your tax liability effectively requires understanding the latest income tax slabs FY 2025-26. With the government revising slabs in the new tax regime and keeping the old tax regime intact as an option, taxpayers face a choice: which regime should you select? In this guide we will explain clearly what the slab rates are under both regimes, what deductions and exemptions apply, how to compare them, and most importantly — how you can decide which regime is best for you.

1. What are the Old Tax Regime & New Tax Regime?

The Indian tax system offers two distinct frameworks for individuals:

-

Old Tax Regime: The traditional tax structure under which you can claim various exemptions (such as HRA, leave travel allowance) and deductions (under sections 80C, 80D, etc.).

-

New Tax Regime (under section 115BAC): Introduced to simplify tax compliance, this regime offers lower tax rates/slabs but in return you forgo most exemptions and deductions. ClearTax+1

From FY 2025-26 (Assessment Year 2026-27) onwards, the new regime becomes more attractive for many, but the old regime remains a viable option for those with heavy deductions.

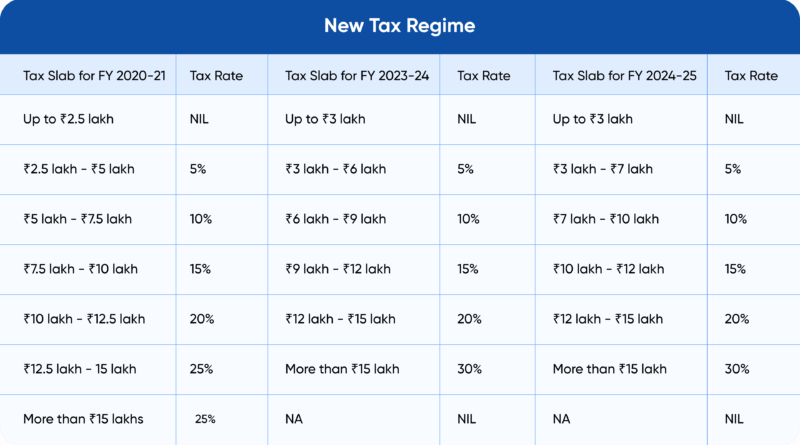

2. Income Tax Slabs for FY 2025-26 under the New Tax Regime

Here are the slab rates for the new regime, applicable for FY 2025-26:

-

Income up to ₹ 4,00,000 – nil tax. ClearTax+2

-

Income from ₹ 4,00,001 to ₹ 8,00,000 – 5% tax.

-

Income from ₹ 8,00,001 to ₹ 12,00,000 – 10% tax.

-

Income from ₹ 12,00,001 to ₹ 16,00,000 – 15% tax.

-

Income from ₹ 16,00,001 to ₹ 20,00,000 – 20% tax.

-

Income from ₹ 20,00,001 to ₹ 24,00,000 – 25% tax.

-

Income above ₹ 24,00,000 – 30% tax. ClearTax+1

Key takeaway: The new regime significantly expands the tax-free band and introduces more gradual increments in tax rates.

3. Income Tax Slabs for FY 2025-26 under the Old Tax Regime

Under the old regime, the slab structure remains largely unchanged from previous years for most individual taxpayers (residents below 60 years).

For example:

-

Income up to ₹ 2,50,000 – nil tax.

-

Income from ₹ 2,50,001 to ₹ 5,00,000 – 5% tax.

-

Income from ₹ 5,00,001 to ₹ 10,00,000 – 20% tax.

-

Income above ₹ 10,00,000 – 30% tax.

Note: There are separate basic exemption limits for senior citizens (60–80 years) and super-senior citizens (above 80 years) under the old regime.

4. How to Choose Between Old vs New Regime

When deciding between the old tax regime and the new tax regime for FY 2025-26, you should evaluate:

-

Deductions & exemptions you currently claim (HRA, home-loan interest, 80C investments, etc).

-

Your estimated taxable income and which slab it falls into under both regimes.

-

Tax rebate under section 87A: In the new regime, incomes up to around ₹ 12 lakh can effectively end up with zero tax after rebate.

-

Simplicity vs optimisation: If you have minimal deductions, the new regime may be cleaner and more beneficial. If you have heavy deductions, the old regime may still win.

5. Example Illustration

Suppose your taxable income is ₹ 9,50,000 for FY 2025-26 and you have moderate deductions.

-

Under the new regime: Up to ₹ 4,00,000 → nil; next ₹ 4,00,001-8,00,000 → 5% = ₹ 20,000; remaining ₹ 50,000 → 10% = ₹ 5,000 ⇒ gross tax = ₹ 25,000. But since taxable income ≤ ₹ 12 lakh, you may be eligible for rebate under section 87A → tax may reduce to zero.

-

Under the old regime: Up to ₹ 2,50,000 nil; 2,50,001-5,00,000 → 5% on ₹ 2,50,000 = ₹ 12,500; 5,00,001-9,50,000 → 20% on ₹ 4,50,000 = ₹ 90,000 ⇒ gross tax = ₹ 1,02,500 (before cess). If you have deductions, this can come down — you must do the maths.

6. Special Notes & Conditions

-

The new regime applies uniformly regardless of age (i.e., no higher basic exemption for senior citizens).

-

The old regime’s basic exemption limit rises for senior (60–80) and super-senior (80+) citizens: e.g., up to ₹ 3 lakh / ₹ 5 lakh respectively in some cases.

-

Surcharge and cess still apply over and above the basic tax in many cases.

-

The new regime forfeits many classic exemptions (HRA, LTA) and many deductions (80C, 80D) in most cases.

-

The tax rebate under section 87A in the new regime allows incomes up to roughly ₹ 12 lakh to pay zero tax (after rebate).

7. Why FY 2025-26 Slabs Matter for Planning

Because the slab structure and regime options have changed, your tax-planning strategies for investments, deductions and salary structuring must adapt accordingly. If you ignore this, you might end up paying more tax than necessary or giving up benefits you could have claimed under the old regime. The widened exempt band in the new regime gives relief to many middle-income taxpayers.

Conclusion

Understanding the income tax slabs FY 2025-26 under both the old tax regime and the new tax regime is crucial. Your best choice will depend on your income level, deduction profile and long-term tax strategy.

If your taxable income is modest and you don’t claim many deductions, the new regime may simplify your taxes and reduce your liability. If you have substantial deductions or exemptions, the old regime may still offer benefits.

Always run the numbers before opting — and consider consulting a tax advisor. With the information above and your own figures, you’re better equipped to make that decision.

Call to Action

For a personalised comparison of old vs new tax regime for FY 2025-26, enter your income and deductions into a reliable tax calculator (links above) or consult a qualified tax professional. Ensure you make the regime choice at the time of filing and structure investments accordingly.

Note: The content above is for informational purposes only and does not constitute tax advice. Tax laws may change. Always verify with official sources or a professional.