How To plan your Budget using a Home Loan EMI calculator

Making your budget planning easy: With a Home Loan EMI calculator

Are you planning to buy your dream home in India? It’s a significant milestone and a prized dream for many. In fact, 80% of Indians prefer taking home loans.Taking a home loan is a major decision and it also comes with financial challenges and careful planning. But you don’t need to worry! With a Home Loan EMI calculator, you can easily estimate your monthly payments and manage your finances better.

What is a Home Loan EMI Calculator?

A Home Loan EMI calculator is an effective online tool that quickly calculates your EMIs (Equated Monthly Installments). According to your loan amount, interest rate and loan tenure, it tells you the EMI amount that you need to pay for your home loan.

Top benefits of a planning your budget using a Home Loan EMI calculator

A housing loan EMI calculator helps the home buyers save a lot of time. Here are some benefits of using a EMI calculator for home loan:

Accurate Result

You cannot afford to make any calculation mistakes when it comes to home loan repayment. An EMI calculator provides accurate and precise results about the EMI amount.

Time-saving

EMI calculators are quick and fast , providing results in just a few seconds. This saves you from manual calculations and helps you make informed decisions about your home loan speedily.

Better financial Decisions

Knowing your EMI obligations helps you make better financing decisions and manage your finances accordingly. Using an EMI calculator prevents any future financial problems.

User-Friendly

A Home Loan EMI calculator is simple and easy to use. All you have to do is enter your home loan amount, interest rate and loan tenure, the EMI calculator will provide instant results.

How can a Home Loan EMI calculator help you plan your budget

An EMI calculator for home loans helps you conveniently choose the loan offer according to your needs and financial budget. You can easily compare different loan options by adjusting the interest rates and tenures, ensuring you choose the most cost-effective one.

Calculating EMI’s is rather overwhelming for the people who are taking a home loan for the first time. A Home Loan EMI calculator makes it efficient to provide you with precise results and saves a lot of time and effort. Using an EMI calculator ensures you get instant results in seconds.

How to use a Home Loan EMI calculator

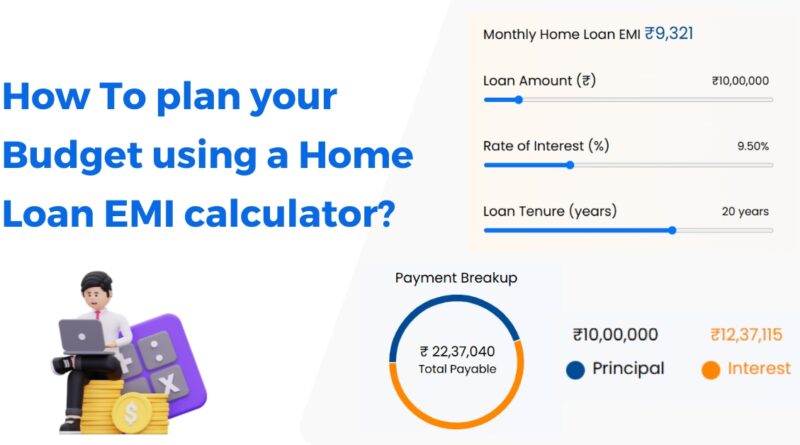

Here is a step-by-step fast and easy process to use a Home Loan EMI calculator:

- Enter the loan amount that you want to borrow.

- Select the interest rate.

- Choose the tenure for the loan in years or months.

- Based on the loan amount, interest rate and loan tenure the Home Loan EMI calculator will show your EMI, total amount payable along with the interest amount.

Here is an example that depicts a loan amount for a home loan, interest rate and loan tenure and the EMI for the same:

Loan Amount :- Rs. 50,00,000

Rate of Interest (p.a) :- 9.5 %

Loan tenure :- 20 years

After entering the above details, the Home Loan EMI calculator will show the following EMI, interest amount and the total payable amount instantly in a few seconds.

Your EMI is :- Rs. 46,607

Interest amount :- Rs. 61,85,574

Total amount payable :- Rs 1,11,85,574

To check your EMI amount, you can use the Shubham Home Loan EMI Calculator.

Conclusion

A Home Loan EMI calculator is an efficient and crucial online tool for all your home loan repayment needs. It is a useful tool that helps you calculate your monthly loan repayments with ease. This tool is particularly helpful for planning your finances, as it provides a clear picture of how to manage your finances each month, smoothly. Additionally, it helps you compare different loan options and choose the one that best suits your budget.

Using a Home Loan EMI Calculator is straightforward and time-saving, making it an essential resource for anyone considering a home loan.